Stock Information & Shareholder Returns | Takeda Investor Relations

Stock Information & Shareholder Returns

Stock Quotes & Chart

Shareholder Returns and Maximizing Corporate Value

Enhancing Shareholder Value and Capital Efficiency

Takeda’s purpose is to contribute to better health for people and a brighter future for the world. Guided by our commitment to patients, our people, and the planet, and grounded in our values, we pursue our vision to discover and deliver life-transforming treatments and long-term shareholder value.

Our R&D is focused on translating science into highly innovative medicines that can transform the lives of patients. We believe that the primary source of our enterprise value and sustainable growth is the ability to continuously deliver innovative medicines, made possible through investments in tangible and intangible assets, including the human capital that underpins innovation and the infrastructure that ensures the rapid and stable supply of high-quality medicines.

Developing new medicines is a long-term endeavor requiring significant financial investment. In all resource allocation and investment decisions, including those for R&D, we always ensure that expected returns exceed the cost of capital with the goal of maximizing return on investment. We also aim to enhance efficiencies and improve profitability by pursuing operational excellence and leveraging data and digital technologies.

To enhance enterprise value, we strive to maintain optimal cost of capital by managing our balance sheet while leveraging external capital and providing timely and transparent disclosures. Within the Global Finance organization, dedicated IR teams based in Japan and the U.S. work alongside senior management to drive strategic and ongoing IR activities.

The Takeda Executive Team (TET) and the Board of Directors regularly review our broad portfolio across therapeutic areas and business units as well as the progress of R&D programs. The TET and the Board of Directors also regularly analyze and evaluate capital efficiency and profitability at the enterprise level using various financial metrics, including Return on Equity (ROE) and Return on Invested Capital (ROIC).

Capital Allocation Policy: Commitment to Growth and Shareholder Returns

Guided by our vision to discover and deliver life-transforming treatments, and supported by our balance sheet (maintaining solid investment grade credit ratings; targeting 2x adjusted net debt to adjusted EBITDA ratio), we will allocate capital to deliver sustainable value to patients and attractive returns to our shareholders.

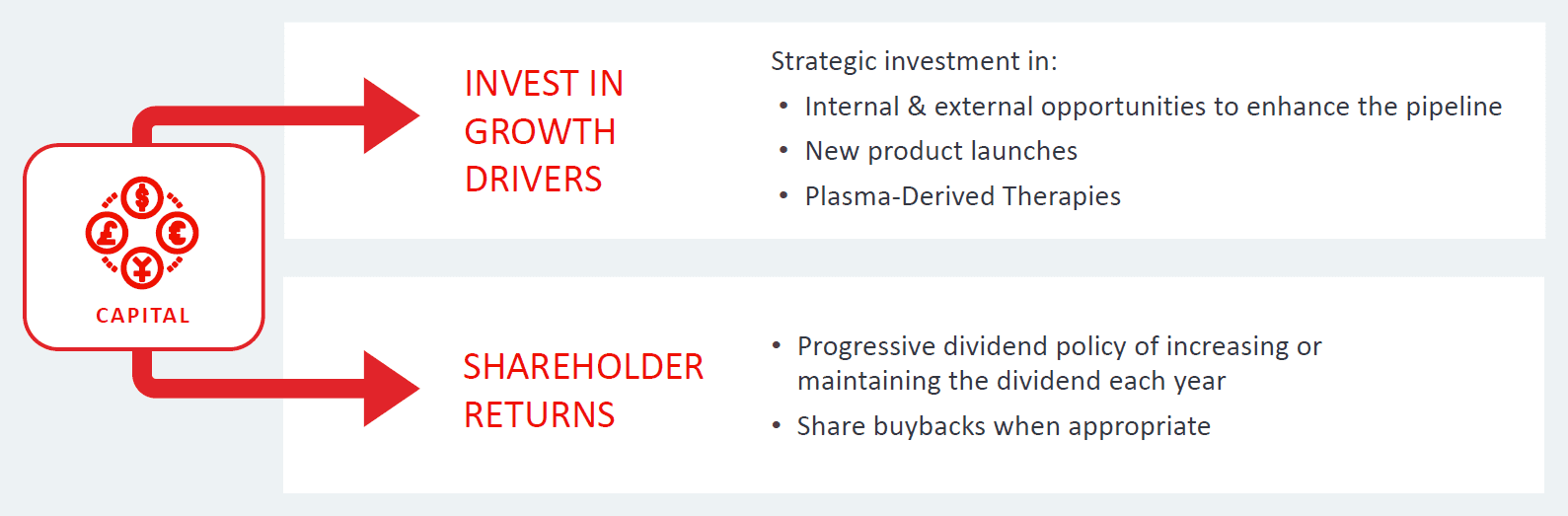

Takeda's policy in the allocation of capital is as follows:

- Invest in growth drivers; and

- Shareholder returns.

With respect to "Invest in growth drivers", Takeda makes strategic investments in internal and external opportunities to enhance its pipeline, new product launches, and plasma-derived therapies. With regard to "Shareholder returns", Takeda has adopted a progressive dividend policy of increasing or maintaining the annual dividend per share each year, alongside share buybacks when appropriate.

Dividends Overview

Shareholder Returns and Dividends

Takeda has adopted a progressive dividend policy of increasing or maintaining the annual dividend per share each year. In addition, Takeda may engage in the acquisition of its own shares when appropriate, including to enhance capital efficiency and improve shareholder returns.

Takeda distributes dividends twice a year. In FY2025, Takeda intends to return cash to shareholders with an annual dividend of 200 yen per ordinary share, consisting of interim and fiscal year-end dividends of 100 yen per share.

Important Dates

Interim Dividends

Record Date | End of the second fiscal quarter, September 30 |

Ex-Dividend Date | One business day prior to the Record Date |

Dividend Approval Date | Board meeting prior to the Q2 Earnings Announcement (around late October) |

Approval will be stated within the Q2 Financial Statements (Tokyo Stock Exchange Filing) found here | |

Payment Timing | By mid-December |

Year End Dividend

Record Date | End of the fiscal year, March 31 |

Ex-Dividend Date | One business day prior to the Record Date |

Dividend Approval Date | Annual Shareholders Meeting (around late June) |

Approval will be stated within the Notice of Resolutions at Shareholders Meeting found here | |

Payment Timing | By mid-July |

For American Depositary Share (ADS) holders

Takeda American Depositary Shares (ADS) are listed on the NYSE.

Please note that 2 ADSs represent 1 ordinary share, and therefore the ADS dividend amount is ½ of the ordinary share amount. The final US Dollar dividend amount will only become known at the timing of payment when our ADS Depositary, the Bank of New York Mellon, exchanges the dividends from Japanese Yen to US Dollars for ADS holders. The final USD amount will be stated on the Bank of New York Mellon’s website.

Registered holders can reach out to Bank of New York Mellon’s transfer agent, CPU (Computershare) for additional information, whereas the beneficial ADS holders holding through their brokers should reach out to their respective brokers for more information. shrrelations@cpushareownerservices.com

In North America: 888-796-2480

International: +1 201-680-6825

Registered holders can also reach out to CPU via the following:

Regular mail

BNY Mellon P.O. Box 43006 Providence RI 02940-3078 United States of America

Courier / overnight / certified / registered delivery

BNY Mellon 150 Royall Street - Suite 101 Canton, MA 02021 United States of America

Shareholder Information

Stock Index (As of September 30, 2025)

Number of shareholders: 659,107

Number of shares: 1,590,985,809

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | Quarter1 FY2025 | Quarter2 FY2025 | ||

| Japanese National and Local Government | No. of shareholders | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| No. of shares (1000) | 0 | 5 | 0 | 0 | 0 | 0 | 0 | |

| % of shares outstanding | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Japanese Financial Institutions | No. of shareholders | 261 | 278 | 266 | 263 | 254 | 246 | 241 |

| No. of shares (1000) | 471,630 | 441,392 | 443,503 | 437,984 | 461,247 | 446,292 | 434,768 | |

| % of shares outstanding | 29.92 | 27.90 | 28.03 | 27.68 | 28.99 | 28.05 | 27.33 | |

| Japanese Financial Instruments Business Operators | No. of shareholders | 72 | 67 | 60 | 67 | 60 | 57 | 58 |

| No. of shares (1000) | 85,167 | 94,871 | 95,220 | 93,862 | 116,242 | 8,625 | 106,012 | |

| % of shares outstanding | 5.40 | 6.00 | 6.02 | 5.93 | 7.31 | 0.54 | 6.66 | |

| Japanese Other Corporations | No. of shareholders | 2,846 | 3,824 | 3,335 | 3,681 | 3,538 | 3,423 | 3,499 |

| No. of shares (1000) | 42,510 | 52,368 | 48,431 | 50,700 | 49,223 | 46,503 | 48,878 | |

| % of shares outstanding | 2.70 | 3.31 | 3.06 | 3.20 | 3.09 | 2.92 | 3.07 | |

| Foreign Shareholders | No. of shareholders | 1,796 | 2,207 | 2,027 | 2,276 | 2,370 | 2,418 | 2,562 |

| No. of shares (1000) | 644,682 | 544,840 | 602,577 | 598,823 | 573,534 | 696,785 | 614,946 | |

| % of shares outstanding | 40.90 | 34.43 | 38.08 | 37.84 | 36.05 | 43.80 | 38.65 | |

| Japanese Individuals and Others | No. of shareholders | 492,704 | 660,159 | 603,893 | 646,485 | 648,557 | 641,234 | 652,745 |

| No. of shares (1000) | 332,225 | 426,131 | 371,098 | 393,534 | 378,970 | 369,199 | 380,093 | |

| % of shares outstanding | 21.08 | 26.93 | 23.45 | 24.87 | 23.82 | 23.21 | 23.89 | |

| Treasury Shares | No. of shareholders | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| No. of shares (1000) | 173 | 22,646 | 21,467 | 7,514 | 11,734 | 23,558 | 6,289 | |

| % of shares outstanding | 0.01 | 1.43 | 1.36 | 0.47 | 0.74 | 1.48 | 0.40 | |

| Total | No. of shareholders | 497,681 | 666,537 | 609,583 | 652,774 | 654,781 | 647,380 | 659,107 |

| No. of shares (1000) | 1,576,388 | 1,582,253 | 1,582,296 | 1,582,419 | 1,590,950 | 1,590,963 | 1,590,986 |

Principal Shareholders

| Name of Shareholders | Number of shares held (thousands) | Percentage of total shares (%) |

| The Master Trust Bank of Japan, Ltd. (Trust account) | 274,016 | 17.29 |

| Custody Bank of Japan, Ltd.(Trust account) | 81,934 | 5.17 |

| The Bank of New York Mellon As Depositary Bank For Depositary Receipt Holders | 64,866 | 4.09 |

| State Street Bank West Client-Treaty 505234 | 34,722 | 2.19 |

| JP Morgan Chase Bank 385632 | 30,880 | 1.95 |

| SMBC Nikko Securities Inc | 30,170 | 1.90 |

| State Street Bank And Trust Company 505001 | 27,025 | 1.71 |

| Nippon Life Insurance Company | 24,752 | 1.56 |

| JP Morgan Chase Bank 385781 | 23,149 | 1.46 |

| The Nomura Trust and Banking Co., Ltd. As The Trustee of Repurchase Agreement Mother Fund | 21,900 | 1.38 |

Credit Rating

(As of June 30, 2023)

| Institution | Rating |

| Moody's | Baa1 |

| Standard & Poor's (S&P) | BBB+ |

| Rating and Investment Information, Inc. (R&I) | A+ |

| Japan Credit Rating Agency, Ltd. | AA- |

Administrative procedures for shares

For American Depositary Shares (ADS) Holders

ADS Depositary Bank: The Bank of New York Mellon (Computershare)

ADS Holders can contact The Bank of New York Mellon's transfer agent Computershare via telephone, in writing or email as follows:

Telephone

Toll Free Number within the United States: 1-888-796-2480

Number for International Calls: +1-201-680-6825

Regular mail

BNY Mellon P.O. Box 43006 Providence RI 02940-3078 United States of America

Courier / overnight / certified / registered delivery

BNY Mellon 150 Royall Street - Suite 101 Canton, MA 02021 United States of America

Email: shrrelations@cpushareownerservices.com

Website: http://www.adrbnymellon.com/

For Former Shire Shareholders (Ordinary Shares) who have not made an election in respect of the consideration

Please contact Corporate Nominee Facility, EQUINITI, via telephone or in writing as follows:

Telephone (Shareholder Helpline)

0330-123-5506 (+44-121-415-0856 if calling from outside the UK)

A text phone is also available on:

0371-384-2255 (+44-121-415-7028 if calling from outside the UK) Lines open 8.30am to 5.30pm (UK time), Monday to Friday (excluding public holidays in England and Wales).

In writing

The Manager, Equiniti Corporate Nominees Limited, Aspect House, Spencer Road, Lancing, West Sussex, BN99 6DA United Kingdom

Or you can send us your query securely by completing the online form at: help.shareview.co.uk

In accordance with the Scheme of Arrangement Corporate Nominee Facility will end two (2) years from the Scheme Effective Date (January 8, 2019). After such time, any remaining shares will be sold and a Sterling cheque issued. Learn more

Have any questions?

Find a list of frequently asked questions specific to Investor Relations, or reach out to us through contact information.